The U.S. Department of Justice (“DOJ”) has made it clear it has the real estate brokerage industry in its sights. In July 2021, the DOJ pulled out of a settlement with the National Association of Realtors (“NAR”) surrounding its policies on cooperation, commission structure, and disclosure within the industry. The DOJ is claiming that NAR’s Multiple Listing Service (“MLS”) rules regarding forced cooperation between listing and buying brokers, in addition to opaque commission disclosure regulation and property access policies, creates an anticompetitive environment within the practice of residential real estate.

NAR, of course, objects to this characterization by the DOJ and outlines within its Competition in Real Estate publication that MLS systems and broker cooperation policies are for the benefit of the consumer and designed to foster competition by leveling the playing field amongst brokers and the public alike. As an open critic of the industry and NAR (see here), I hold no sacred illusion of NAR intending to regulate the existence of real estate utopia. However, prior to advocating for or condemning the policies set by NAR, the true intent of the DOJ must be examined.

The Setup

As a practitioner within the field for almost 20 years, I have been witness to countless acts of industry bad behavior and attempts at bureaucratic overreach. There is ample data from which to argue for or against either position. The summary withdrawal of the DOJ from its settlement with NAR, however, so soon into the Biden administration, with the initial settlement having been finalized in November 2020, the end of the Trump administration, was a clear indication of its intent to make a significant move whether for political or ideological reasons. After all, the rules that were, or are now, the subject of DOJ scrutiny have been in place for a very long time. If it were such a clear-cut case of antitrust activity, why only now is the government deciding to act? Within its settlement withdrawal statement, the DOJ specifically references a purported $85 billion in commission fees paid last year to members of NAR. Is this an attempt to protect the public or a political exercise to topple a successful industry? After all, the sum referenced in commission fees when averaged across the entirety of the more than 1,500,000 members of NAR amounts to less than $60,000 per practitioner annually, hardly a self-enriching figure by any measure.

These actions could very well be a positioning of the DOJ for outright elimination of the buyer broker. The anti-competitive assertions within the initial DOJ Complaint are that under current NAR and MLS rules, a listing broker holding membership in NAR is required to cooperate with a buyer broker to the extent that it must make an offer of compensation to that buyer broker. There is, however, no required percentage or dollar figure associated with this cooperation mandate, and, in consideration of that fact, the real estate industry argues that price-fixing and anti-competitive practices cannot exist when there is no required cooperation fee. Arguably, fees are a result of natural market forces working to find a reasonable value proposition for all, regardless of the government’s objection to the volume collected by practitioners.

From the industry’s perspective, a listing broker charges a fee to a home seller, a portion of which is used to incentivize a buyer broker for procuring a buyer for the property. Whether the listing broker offers a large or small portion of its fee to the buyer broker is entirely up to the agreement between the listing broker and the seller. In such structure, both a seller and buyer, presumably, are working with informed representatives acting in the interests and benefit of their respective customer or client, thus creating a balance in the market that, all other things being equal, keep the market in its proper equilibrium.

DOJ’s Initial Contentions

There were four (4) outlined elements defining the Nature of the Action.

- Prohibition of MLS systems disclosing buyer broker commission rates;

- Allowing buyer brokers to represent their services as free;

- Enabling buyer brokers to filter MLS listings based on level of offered commissions; and

- Limiting access to lockboxes only to broker members of NAR.

In short, these issues were remedied within a proposed settlement where NAR would amend its policies to reflect appropriate changes. The big dust up here is that DOJ summarily withdrew from the settlement to reassess its position, create more broad possibilities to attack the industry, and not be bound by any other settlement terms. At the core of the DOJ’s issues with NAR policies is the compulsory element of these regulations and their purported exclusion of competitors.

In practice, saving potentially for lockbox access, though that access does not prevent any non-NAR member from contacting a listing broker for access, these claims do not seem to pan out. As an industry member, I would have anticipated MLS access as a primary element of complaint, after all, there are a handful of new brokerage models operating within U.S. engaged in active litigation with NAR over this very issue.

Though there are exceptions, any broker, listing or buying, is required to be a member of NAR to participate within MLS systems, the largest and most expansive sources of residential real estate data in the U.S. In essence, if a broker is not a member of NAR, it cannot access much of this information and, effectively, cannot participate within the industry despite holding a state issued professional license. That practitioner is then rendered functionally useless to the public. Surprisingly, this was nowhere within the DOJ Complaint. A similar structure exists on the commercial side of the practice as well with CoStar and LoopNet. It is entirely a payment for access game. Should those who built the systems be required to open access for all? Is not the argument against big data and social media along the same vein?

On this matter, the other side of this argument is that brokers do, in fact, have access to this information through public record filings and third-party data brokers, just not at the same speed or in the same format as provided by MLS systems. We are then back at the core of the government’s argument in that speed of access to these systems and the information they contain create the value to the industry and the public. But there again, these systems were not designed, built, or deployed by the government, so what place does it have to interfere with its operation? Both arguments are endlessly circular.

On the offer for compensation required of listing brokers to buyer brokers, and that offer not being publicly viewable by the consumer, allows buyer brokers to advertise their services as “free” to the buyer market. In practice, this is just a case of semantics. Are buyer broker services free? No, they are not, but they are almost always free to the buyer, which is the spirit and outward purpose of those marketing claims. Perhaps I do not travel in circles that advocate for the “free to you” service provision, but I cannot remember a time where this was an ever-present marketing technique used broadly by brokers. I could certainly understand some cause for misrepresentation, but antitrust? Clarity, seemingly being at the core of any argument here, would lead one to conjure an imposition of simple marketing rules surrounding party and fee disclosure. There is certainly no shortage of existing rules on a myriad of other issues, which is the likely driver of the simple modification within the proposed settlement prohibiting such activity.

As a practical matter, I do not know of any broker who has made a career in real estate who does not understand or advocate value for service. If the contention by the DOJ on this issue is that the concealment of buyer broker fees to the public inflates buyer broker fees, I would not expect seasoned brokers to have an issue with disclosure as they do not rely on this messaging anyway. As a free market believer, if there really is a real value to the buyer broker, and I know there to be quantifiable value when a skilled practitioner is engaged, disclose fees, and let the buyer choose the provider.

Ultimately though, even with this disclosure, there will not be a fix to this issue if the offer for compensation is coming from the listing broker. A buyer broker may be flatly unqualified and out of depth, but the buyer would not have any control over payment, again leading to my belief that the new drive by this administration is to eliminate the traditional buyer broker relationship.

Sorting listings by compensation, another easy change within the proposed settlement, seems to be another rather inconsequential issue. Ultimately, if a broker is choosing not to show certain properties to buyers based on compensation, natural market forces will take their course. The real estate business is incredibly local. If there is an agent or broker behaving badly, the market will know, and if consumers get wind of that behavior, and they do, the broker’s business will suffer.

Sorting, however, does not get around anything. Unless the remedy would be complete concealment of commission fees, a broker is who is going to act based on the commission offering, whether they must look at 10 or 15 more properties, will not change business practice based on this rule. This would purely have been a vanity exercise to appear as though important action was taken and is yet another reason I believe the current administration has backed out of the settlement and is positioning for much greater and more sweeping action.

Industry Response & Considerations

More recently, Realogy Brokerage Group and Coldwell Banker CEO, Ryan Gorman, has called for the recission of the mandatory cooperation rule for listing brokers to input MLS listings. To be fair to his statement, it was contextually surrounding the MLS mandate for buyer broker compensation as a condition of MLS listing input, not an altogether elimination of buyer broker compensation. This position, however, falls in line with the Biden administration having been quite vocal as to its intent to breakup and/or reform what it deems to be anticompetitive activities or businesses with which it has issue. Considering the intrusion of government into the lives of U.S. citizens over the past two years, objectively, a questionable eyebrow should be raised when it comes to the government defining whether an individual or entity’s activity is kosher or essential.

Unsurprisingly, Gorman received near immediate backlash over his statements from industry practitioners. At the core of his statement, however, is a free market principal, let the market decide. If buyer brokers are truly needed, a forced offer for compensation is unnecessary. The market will find a way for buyer brokers to be compensated for their efforts within any given transaction. On the other hand, why should a buyer broker engage a listing on behalf of a buyer without knowing what compensation will be offered. Afterall, sellers are not required to pay an arbitrary commission amount and only pay what they have agreed to within a written listing agreement. A change to what we call the traditional structure within the industry, one that has evolved over decades, may upend residential real estate markets and the way in which transactions are conducted today. Significant structural changes could very well limit buyer access to the market and hurt buyers rather than help them as well as see to drive prices even higher, a not so uncommon result of large-scale government tampering in private industry. We need only to look towards healthcare to make this point.

Buyers are subject to extreme financial scrutiny during a purchase and most individuals cannot afford to independently pay a buyer broker out of pocket for reasonable levels of service. This then brings in a host of additional considerations. Should there be a cap on commission fees? Should broker liability decrease with any fee-fixing subsequent to government intervention? Should buyer commissions be rolled into a loan? Should a lender then be required to lend against unsecured collateral (commissions)? Should buyer brokers finance their services to buyers and be repaid over time? Should that financing be permitted to encumber the property? All of these scenarios open significant structural considerations that would very likely require new regulation with, of course, the associated bureaucracy and government management of these systems, resulting almost certainly in rising prices. Perhaps, as the government may intend, eliminating buyer broker relationships altogether is the solution.

Parallel to these issues, we also cannot forget that NAR is attempting to protect itself, whether directly or indirectly. Though the arguments it makes are seemingly cogent, if changes to compensation structure are made and buyer brokers are forced to either negotiate their fee on a transaction basis, or that fee is price-fixed through regulation, it could lead to a significant reduction in total NAR membership and cause a major loss for NAR funding through dues, education, and services charged to its members each year.

Why Now?

While I am not a lawyer and am offering no such legal assessment of DOJ’s positions, Americans do not have any constitutionally protected right to housing or housing representation. Also, though DOJ cites $85 billion in annual fees in the context of excess, homeowners have seen trillions of dollars in equity and value appreciation over the past few years. If that is the case, why would the DOJ claim intervention within the brokerage market is serving to protect the interests of the public? Objectively, it is very likely due to the dismal reputation of many real estate agents and brokers. As it is said, a few bad apples can spoil the bunch. And I say this as an active real estate broker.

Almost every person who owns a home has experienced or knows someone who has experienced a bad transaction with a real estate agent, which serves only to sour the reputation of the many practitioners who are high-performing, very skilled within their field, and whose primary objective is the protection and benefit of their clients and customers, yet there exists a reputation of fee grabbing and excess. The reason? It is twofold. Lack of national leadership, NAR, leading to lack of broker accountability.

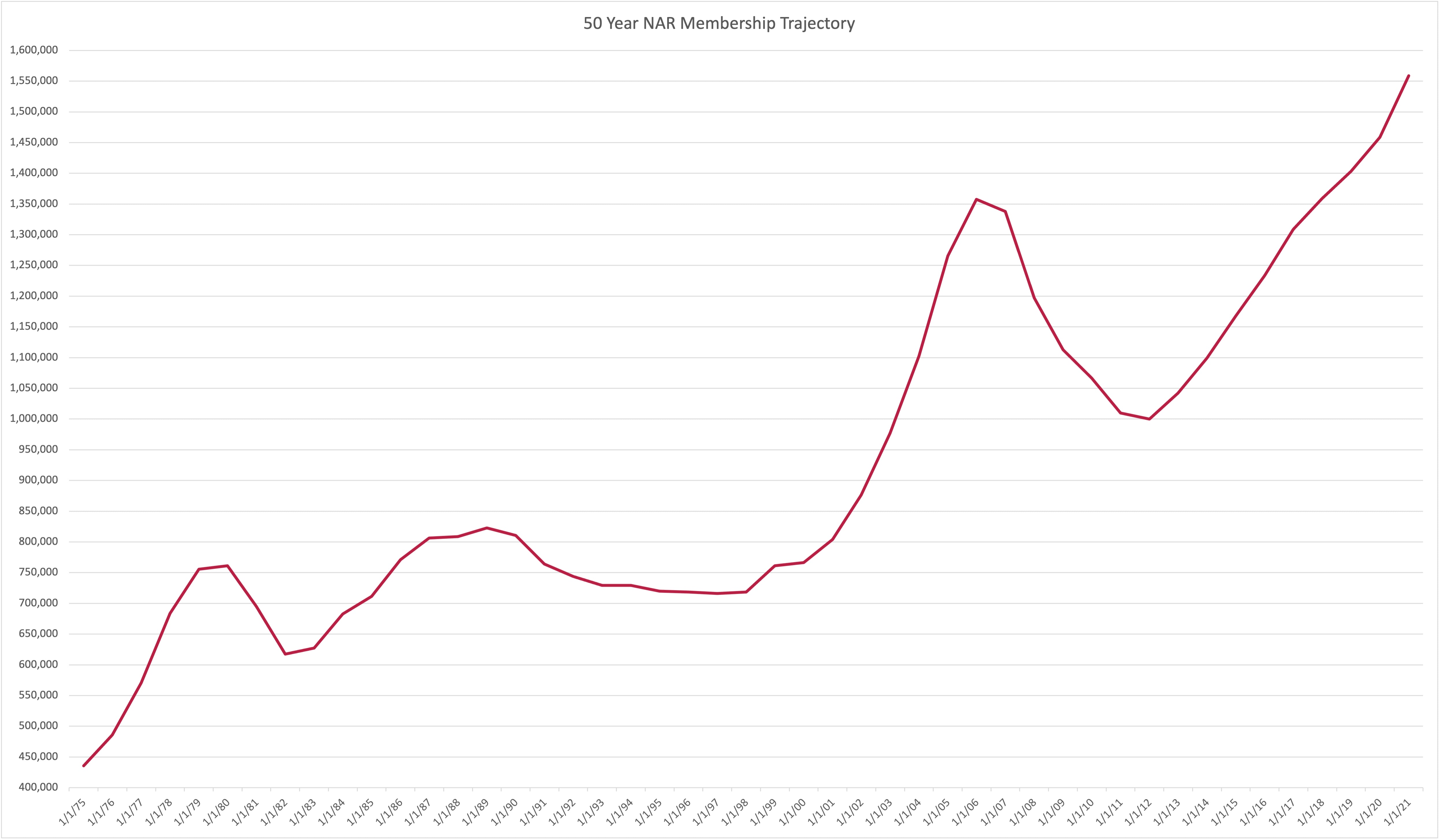

From 2006 to 2012, leading up to and following the 2008 financial crisis, numbers of real estate practitioners within the U.S. dropped by 26% from 1.36 million to 999 thousand. From 2012 to today, practitioner count has rebounded by 50% to over 1.5 million (see Fig 1). During that same period, other professional fields, law, medicine, and financial services, saw no decline in practitioner count and have experienced stable and consistent single digit percentage growth. Why? In short, there is almost no barrier to entry within this field.

Fig. 1

On the state level, licensing requirements are almost worthless beyond the bureaucratic check mark following test completion. In Florida, to become a broker, the individual licensed to supervise real estate practitioners, two years licensure plus a maximum of 260 classroom hours is all that is required. A typical salesperson spends less than half that time in a classroom. By comparison, in Florida, a licensed cosmetologist endures 1,200 hours of classroom time.

For virtually every U.S. homeowner, their property represents the most valuable asset they own. The intricacies of a real estate transaction are considerable. A lot can go wrong if a practitioner does not know what they are doing or if they lack sufficient support. Considering the potential ramifications of a failed real estate transaction, should not the shepherds of those transactions be held to the same standards as, say, a physician or an attorney?NAR, according to its 2021 Dues Information, generated an estimated $220 million in revenue from membership dues. It estimates almost $83 million of that will be attributed to political lobbying. That is not even addressing the countless millions generated through education, products, research, data, etc. If members of NAR are an equivalent to shareholders, I believe we could classify that $83 million as malinvestment…but I digress.

This body is supposedly responsible for being the champion of the industry and representing the interests of its members. Occasionally, as a member, I receive updates regarding issues NAR claims to have won legislatively on behalf of the real estate industry, but I certainly do not see $83 million worth of lobbying effort. Purely speculative, but I surmise that a hefty portion of that amount is spent on the state level advocating for the maintenance of low-level licensing requirements and bolstering of NAR’s membership ranks.

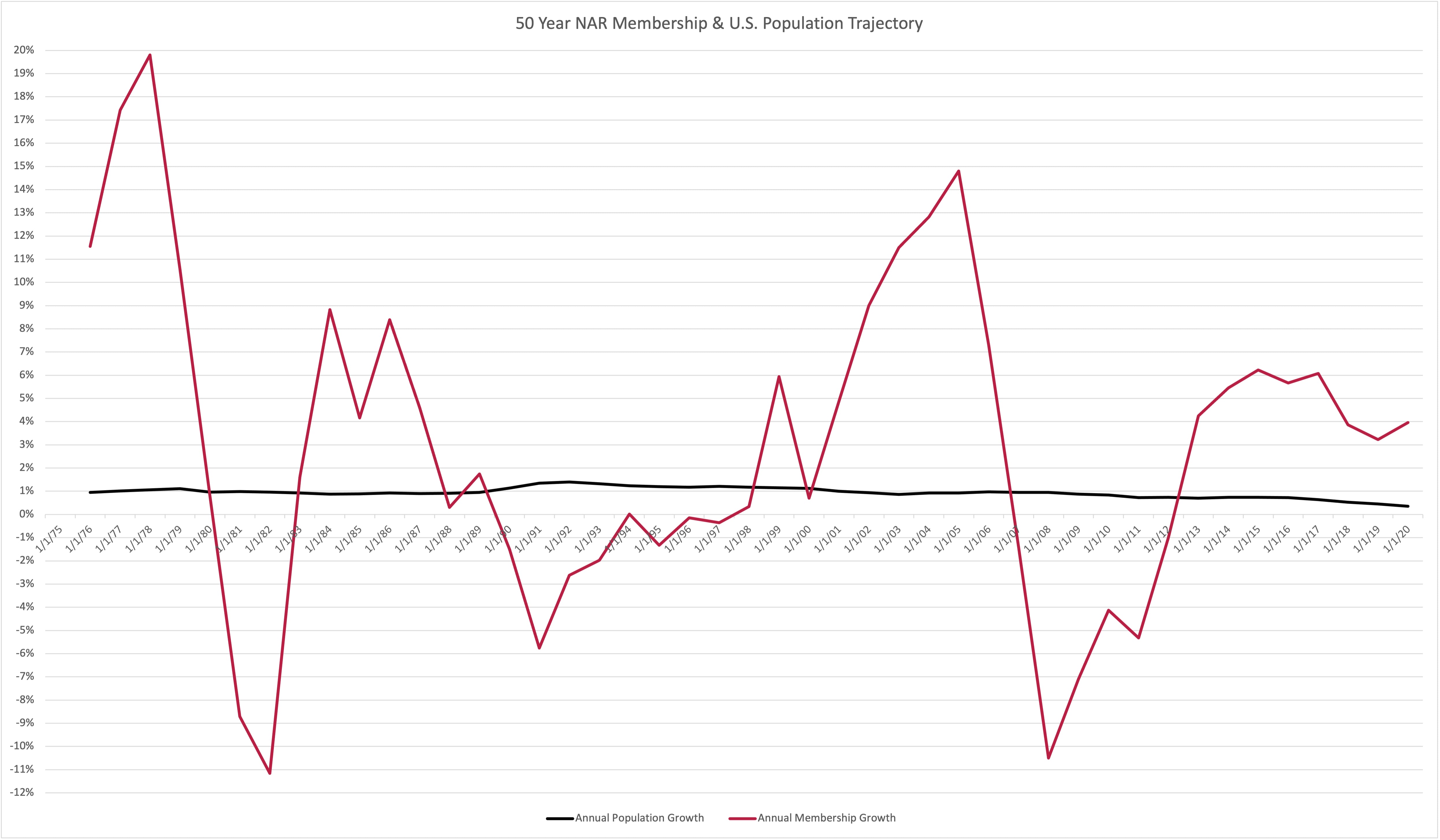

The incentive system in real estate is upside down. The maintenance of low industry standards fuels the massive volume of real estate practitioners, thus filling its coffers with membership dues. If it were truly a champion of the industry and the practitioners who operate within it, the association would define professional standards. There is no set standard for business skill, real estate and market knowledge, experience, or apprenticeship. If you have a license, you’re in. Just have a look at NAR’s annual membership growth laid against U.S. population growth (Fig 2). A perfect statistical correlation, no, but a visual representation of there being absolutely no rhyme or reason to NAR member attrition other than market volatility, an external effect not even remotely experienced on the same order by any other professional field.

Fig. 2

This sloppy top-level structure only incentivizes low quality industry performance. National real estate brands are racing to the bottom through “high split” and “fee-based” structures, abandoning traditional industry values and what most benefits the end consumer only to capture practitioner market share, the number of real estate agents within the respective company. From a free marketer’s perspective, I do not have a general issue with these organizations finding the formula to maximize profit and market share, but everything comes with a cost, hence current DOJ intervention and investigation.

Rather than emphasize quality of service, skill of practitioner, and differentiation within the market, there seems to be an almost exclusive focus on creating profit centers around real estate practitioners rather than the practice of real estate. Large brokerage houses have abandoned the emphasis of skill to drive greater real estate business, and instead emphasized fees for franchises, closings, desk space, office supplies, technology, compliance systems, and so on.

These commission structures designed to win the practitioner game are disincentivized to support any individual practitioner, only to increase total number of practitioners. If a company operates within the fee-based system, total fees never present sufficient capital for investment in the practitioner.

Regardless of how this may pan out, one this will likely be certain, listing brokers and agents will come out on top. In an industry that is so easy to be pigeonholed into one form of representation or another, let this serve as a present reminder that diversity is the key to long-term success, diversity in representation, practice area, and skill set.

About the Author: Click here

Related Posts

The Broken Business of Real Estate

Today, the business of real estate has little to do with actual real estate.

3 Tips To Avoid Being a victim of Wire Fraud

Wire Fraud is a very real threat in Real Estate transactions today and millions are lost each year...

Supply Controls 2022

It is unarguable that the residential real estate market was on fire in 2021. Florida’s market saw...