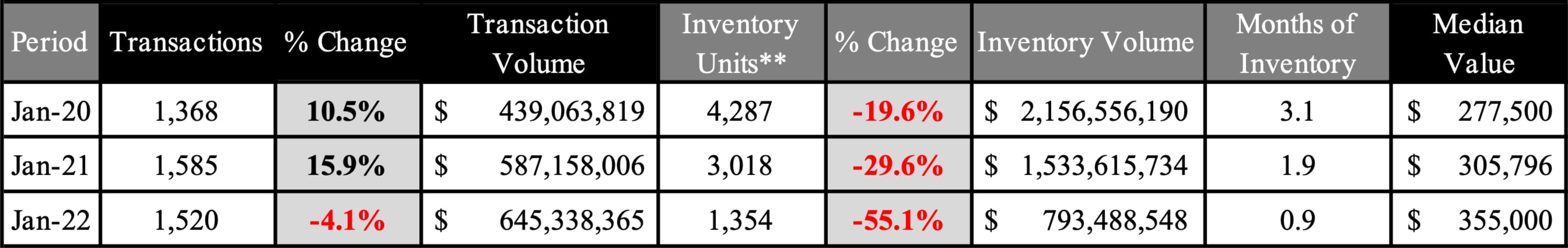

The past several weeks have been filled with noise and statements about the Federal Reserve tapering its mortgage backed securities purchases and the coming increase in its target funds rate. The resulting increase in mortgage interest rates have had many wondering whether this would quickly cool the fiery housing market here in Central Florida. As of the end of January in Orange County, the are no such signs of cooling. Total transactions are nominally down from January 2020, though having seen 2020’s Q2 sales cycle moved ahead into Q3 2020, the slight decline we now see in transactions is likely a return to normal seasonal activity when considering population growth in Central Florida.

Orange County - January Performance Trend*

* Source – Stellar MLS - **Inventory Units does not consider the entirety of planned new construction projects in the region.

Rate Movement

As a reaction to policy changes or other economic activity, rate changes are a lagging indicator in real estate and take time to move the market. We may very well see a cooling in housing should rates rise to a level where actual affordability is challenged.

In 2022, average 30-year fixed rate mortgages moved from +/-3.1% to +/-3.8%. If we assume a very high loan-to-value conventional mortgage, 95%, using January’s median home value, the principal and interest payment moved a little more than $100 per month. This rate movement in and of itself does not present an affordability challenge. If we were to see a sustained rise in mortgage interest rates at this pace over the coming year, that would certainly introduce the concern over affordability and likely slow residential absorption. Federal Reserve movement and time will tell whether rates continue sustained upward movement and to what degree they will adversely affect real estate markets.

The Inventory Question

Inventory is the ever-present challenge. Over the past several years, we have seen a persistent and significant decline in overall housing inventory within the Central Florida region. Post pandemic, suburban relocation and rate fueled purchasing have likely reached their peak. The slowing of that feverish purchasing may provide a breath for inventory to begin a rebound. The question now surrounds continued regional population growth and if its growth is sustainable for the housing market and within which product type will that growth persist.

Multifamily construction is booming in the region. One needs only to drive within a small radius to see large apartment and condominium structures coming out of the ground. As with observation of rate effects, timing is the challenge in this arena. Will product availability meet market demands and will the fervor of low inventory drive excess construction? Time will tell.

As for the single-family housing sector, demand is likely to remain strong within the region. If we are to assume that pandemic suburban sprawl and exclusively rate-driven purchasing has calmed, inventory should slowly begin to climb. The spring buying season, however, will be the real tell in this area. With less than a single month of existing home inventory within Orange County, should we see the anticipated surge in buying absent a matched growth of existing home inventory coming online, we may find ourselves in a very locked up position. The hope is that we will see existing home inventory track upwards along with sales activity into the coming sales season. February and March sales and inventory activity will provide us with insight into the anticipated trajectory of Q2 and Q3 sales and inventory levels. Saving for significant financial, political, or global market disruption, which, in those events, all bets are off, the residential real estate market within Central Florida in 2022 will likely perform similarly to 2021.

Affordability

Residential real estate values are unquestionably at historic peaks. Does this mean, however, real estate is not “affordable?”

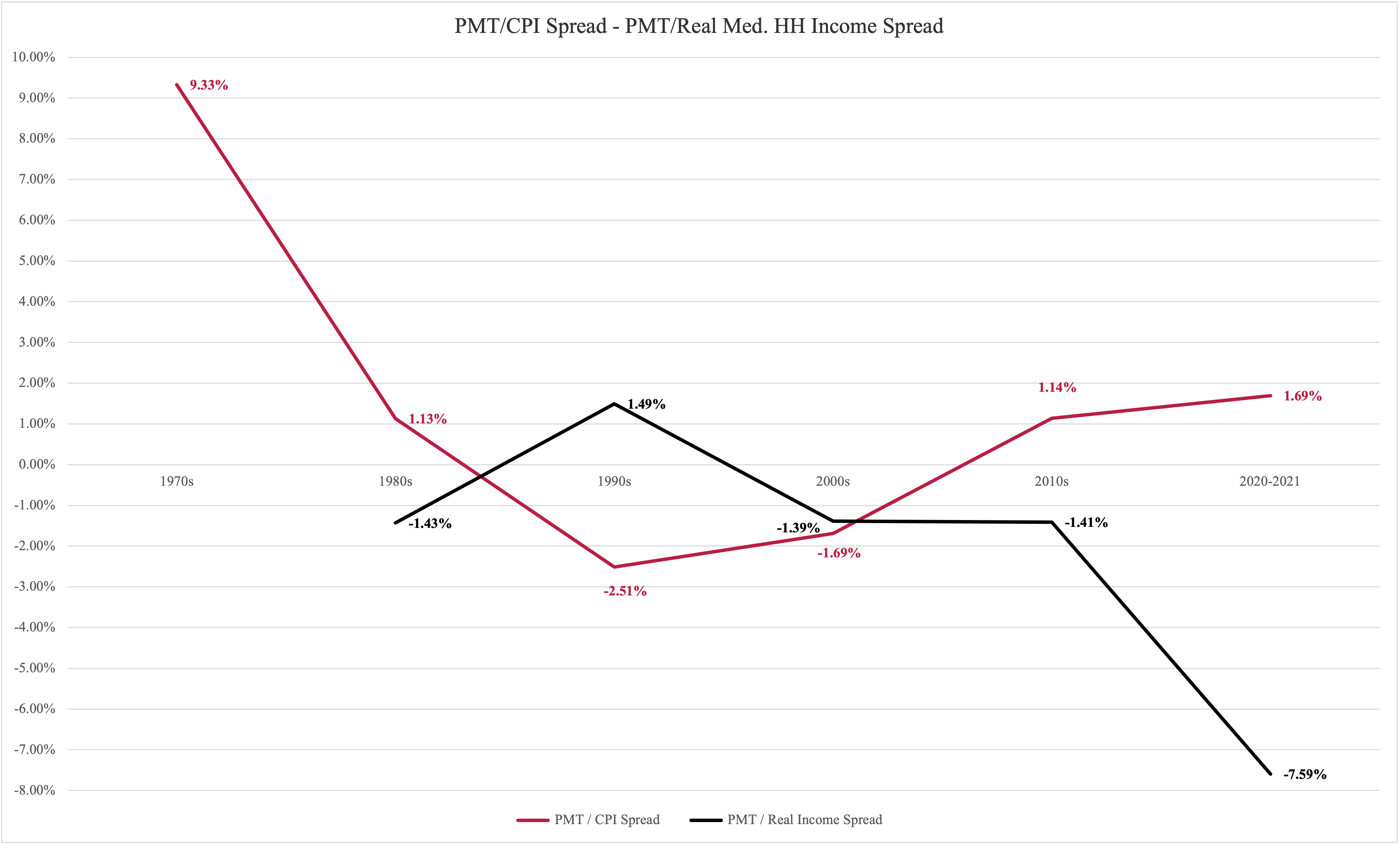

Relatively speaking and within the greater context of time, the spread between the rate of change between a median value 30-year fixed rate mortgage payment and the Federal Reserve’s CPI has been narrowing since the 1970’s. Within the context of cost of capital and absolute affordability, housing is not “unaffordable,” just the opposite. In recent decades, it was only in 2021 as an outlier value growth year that we saw any meaningful upward shift in the greater affordability equation.

The obvious objection to saying real estate is affordable is that housing is very expensive in nominal terms, the actual dollars it takes to purchase and maintain real estate. Though there is significant explanation required to run down the list of drivers, pricing pressure is not affordability pressure within real estate as we would think about it in an historical context. Relative to other essential spending items, the affordability issues we see today are largely external to real estate.

Real household income relative to housing cost has been on the decline since the 1970’s fueled by shifting industry demands and increasing line items such as healthcare, transportation, student debt, and food. Housing is an expensive line item, yes, though its relative affordability compared to other essential spending items has not risen as substantially. The balance within these essential expenses relative to income is significant and detailed, more so than we can adequately cover here. The complex unwinding of minimal real household income growth is the most significant underpinning of housing being categorized today as largely unaffordable.

The longer-term observation of the growth or decline of these expense items will be tremendously important as we move into a monetary policy shifting cycle if we are to place affordability within any reasonable lens. Conventional wisdom would imply a deflationary environment as rates rise, though it is safe to say that convention is questionable as political throws influence our economy to the massive degree that they do today.

Demand in the Long Run

Projecting demand over the long-term will be a challenge. From a traditional demand driver perspective, it is highly likely that remote working will be with us forever and the need for corporate relocation and job movement will measurably reduce within certain industries. We also see the rate of U.S. population growth slowing and marriage rates on the decline, two principal drivers for housing demand. Collectively, these demographic issues present long run housing challenges.

If we are to assume Florida, and Central Florida in particular, remains as attractive a living and tourism destination as it is now, our local real estate market demand is likely to persist for many years to come, though strict observation of cost relative to affordability, inventory, and shifting demand will be critical to understanding in what direction we are headed.

About the Author: Click here

Related Posts

Who will be Eaten Next?

This will be an empirical industry writing. It will stem from personal experience and observation....

Supply Controls 2022

It is unarguable that the residential real estate market was on fire in 2021. Florida’s market saw...

What are Real Rates?

If you’ve been following along with interest rate conversations over the past several months, it is...