If you’ve been following along with interest rate conversations over the past several months, it is very likely you’ve heard the term “real rates.” This term may present as counter intuitive. After all, regardless of the asset class, debt type, return, etc., there is an interest rate. So why would a stated interest rate not be the “real” rate.

What are “Real” Rates?

Real rates are simply the nominal rate (stated rate) minus inflation (expected or actual). If, for example, a lender was collecting 5.0% on a fixed rate loan (real estate mortgage) and inflation was 2.0%, its real yield would be 3.0%, a condition we would describe as a positive real yield. Similarly, if the Federal Reserve’s Effective Funds Rate (Fed Funds Rate) is 0.25% and inflation is 2.0%, the real Fed Funds Rate would be -1.75%. Real rates being either positive or negative can be thought of in how we think of purchasing power, the impact of one dollar invested either growing or contracting in its ability to generate returns. A positive real return would mean that your purchasing power grows, while a negative real return would mean that your purchasing power is declining.

This concept is sometimes lost due to rates being placed within a comparative framework, e.g., this investment returns rate X and that investment returns rate Y. It can be easy to forget about how that investment, regardless of its comparison to alternatives, performs in the greater context of a market and economy. This is most aptly demonstrated when following treasury yields.

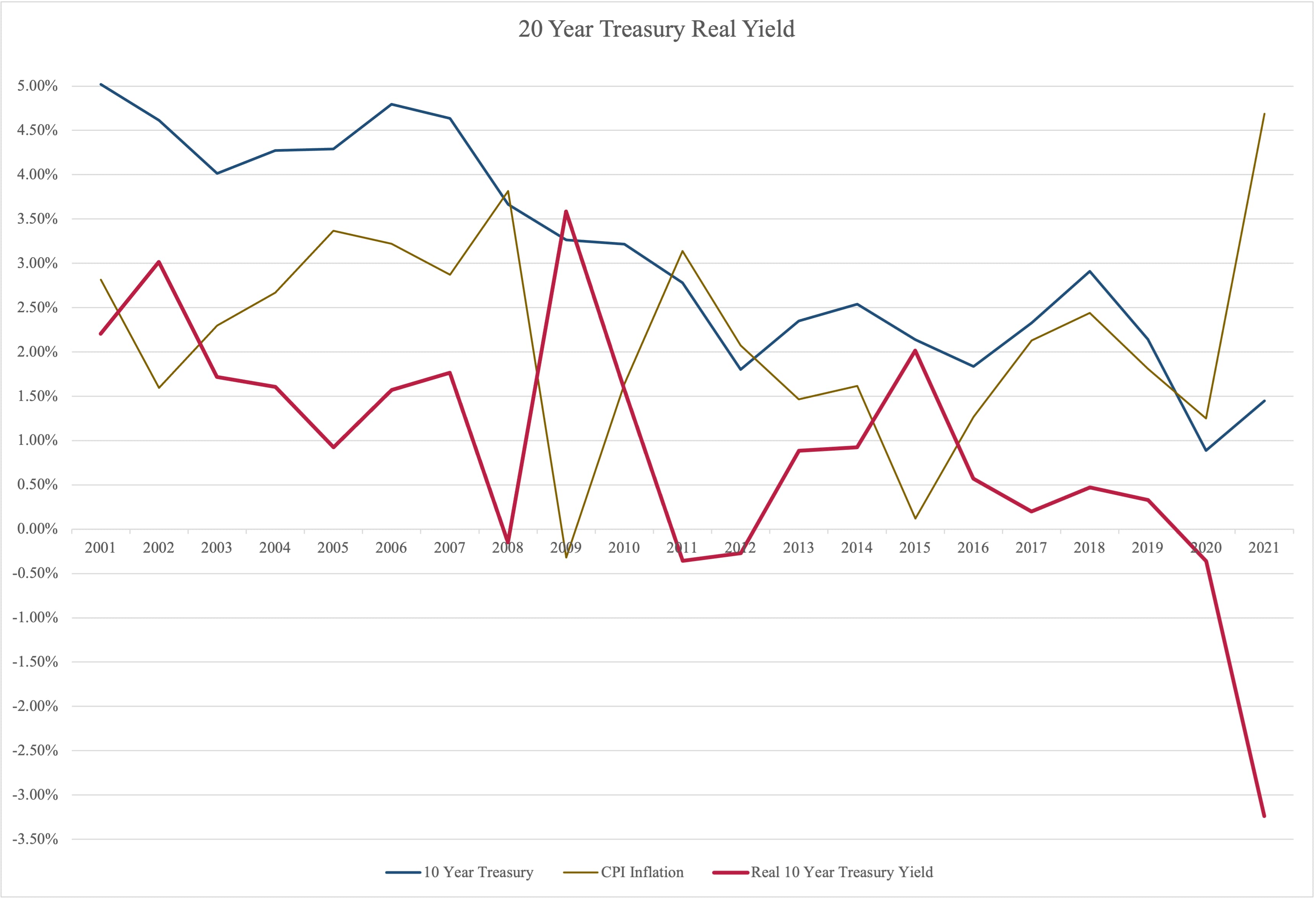

Traditionally, U.S. treasuries are thought of as the risk-free investment vehicle, one that does not generate extraordinary returns, but that can be counted on for stability and security. In that conventional wisdom context, treasury yields would even serve as the discount rate for the low-risk segment of a portfolio. In today’s market, with years of zero interest rate policy, we can see the long-term direction of yields and the effects of inflation on real treasury returns, the 10-year in this case (fig 1).

Figure 1

How are Real Rates Measured?

Using the U.S. treasury example, annual inflation rates were calculated using the U.S. Census Bureau Consumer Price Index for All Urban Consumers: All Items in U.S. City Average. While good for capturing the broad context of pricing, this index, for example, does not fully consider the real cost of housing. Its surveying method for Shelter and what is defined as Owner’s Equivalent Rent” simply does not properly capture the nuances of real estate. That is not to say that using this index for developing a broader awareness of pricing is not valid, it highlights that the process of determining a real rate of return should narrowly consider the application of the investment rather than broadly compiling several areas together.

While a CPI measurement works for big picture, it can create an apples-to-oranges view if an investor relies solely on an index vs. an individual asset class or sector. The categorization of the measurement and what inflationary position it is measured against will make or break the model of expected returns…and with the potential for volatility today being very real, category is very important.

Partially playing into how mortgage rates are priced, investors, whether the U.S. government, or private mortgage-backed securities buyers, are in a constant search for balance, measuring risk against return against alternative. Though the government’s backing of federally underwritten loans plays a factor in reducing some lending cost, private lenders and investors would not be in the MBS market if there were equal alternatives in other sectors.

Why Would Investments be Made if Real Rates are Negative?

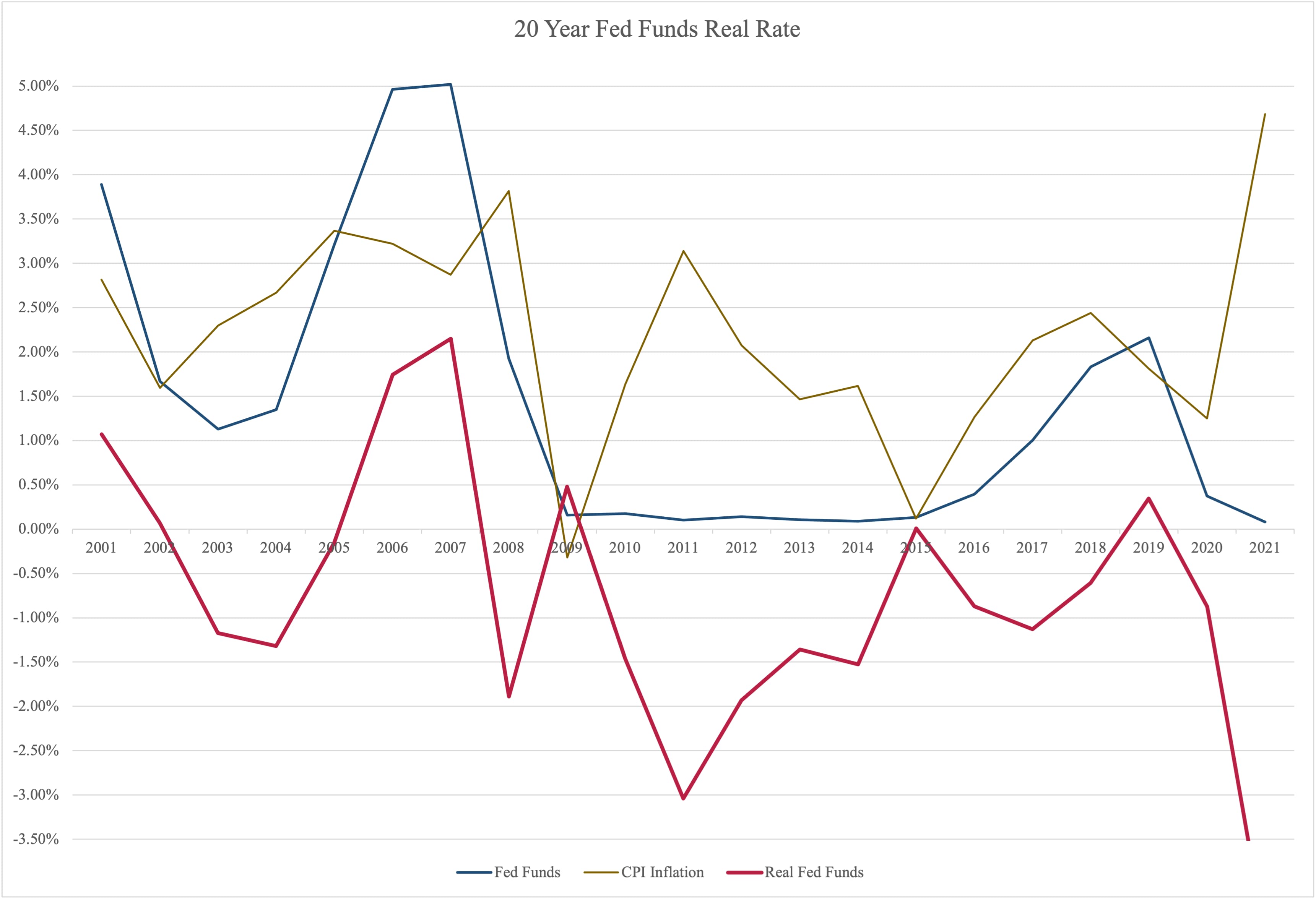

As we see with treasuries dipping into negative real yields, the Federal Reserve’s Effective Funds Rate has been negative in real terms for several years (fig 2). If real rates are negative, both in scope of return and benchmark rate setting, why would investors still pour money into markets? The answer is in alternative.

Figure 2

If the real yield is negative, there are three alternatives. The first is to do nothing and keep money sitting idle. In this scenario, the investor is not only losing on opportunity, but principal is also eroded through the cumulative loss of purchasing power through inflation.

If real yields are negative, the second option is to invest conservatively. There is greater capacity for preserving purchasing power when dollars are invested rather than sitting. This is the philosophy behind greater monetary policy in that as rates move downward, there is, theoretically, incentive to actively invest into the working economy. The investor is likely to maintain positive nominal performance, just not high real performance.

The third option, one we have seen lead to rapid financial market appreciation over the preceding decade, is the chasing of greater real returns. Equity (stock) investing is an environment that can return far above real yield performance of bonds or fixed indices, but it too carries with it much greater risk of volatility and loss. To unravel the drive into equities and the growing of equity markets over the preceding several years, there is lengthy discussion needed beyond this writing regarding debt load and debt based financial asset purchasing.

Considerations.

The conversation of real rates or yields is most often applied in the context of bonds, other forms of fixed debt (real estate), or indices as the conversation generally centers around averages and historic performance. Though my view is almost exclusively through the lens of real estate and hard asset performance, investors, regardless of asset type or sector, should be aware of and consider appropriate placement of capital and/or alternatives. We are at some form of inflection in the market. Broadly, there is constant discussion of correction, overvaluation, inflation, spending, debt, and on and on. Pay attention, ask questions (a lot of them), and make informed decisions.

About the Author: Click here

Related Posts

2022 Orange County Florida Annual Rental Report

Despite talks of a recession, the Orange County, Florida rental market remained strongin 2022....

Supply Controls 2022

It is unarguable that the residential real estate market was on fire in 2021. Florida’s market saw...

Everyone is Watching the Yield Curve

Today’s Market